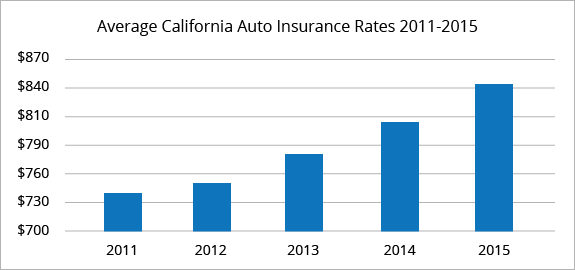

If you want your prices covered, think about acquiring complete coverage.What Is the Typical Price of Car Insurance Policy in California?, California drivers pay, on average, $1713 a year for cars and truck insurance coverage - insure.

What Are the Leading Insurance Policy Companies in The Golden State? They advise that you purchase a plan from a business with high customer satisfaction rankings. cars.

Industry information shows that The golden state has a lot more hybrid as well as electric vehicles on its roadways than any type of various other state. When you buy one of these automobiles, your insurance company will award you with a price cut.

Just How Much is Full Protection Auto Insurance Coverage in The Golden State? However, so as to get the finest cars and truck insurance in The golden state, aka low-cost auto insurance policy that likewise keeps you well secured on the roadway, we recommend complete coverage car insurance policy, which has an ordinary The golden state auto insurance expense of $142 monthly or $1,700 annually - cheap insurance.

This is likely due to the fact that The golden state chauffeurs have to deal with a lot of website traffic (specifically in huge cities with packed rush hours) (insurers).

!! When you compare auto insurance policy quotes in The golden state, be certain to accumulate a maximum quantity of full coverage car insurance estimates that have your needs shielded, so you can later on make a decision which is the least expensive California reduced price vehicle insurance coverage choice that is also reputable and protective sufficient. Whether you're brand-new to the state and also looking for automobile insurance policy coverage, or you have actually lived in The golden state for years and desire

to find how discover just how car insurance in Insurance policy, the golden state the choices you have for best & ideal insurance inexpensive insurance coverage on coverage, protection'll find the locate you need here. auto insurance. The golden state cars and truck insurance coverage laws additionally consist of a crash insurance deductible waiver option, a necessary good vehicle driver discount rate for qualified chauffeurs, a low-income choice for qualified chauffeurs, vary from various other states in that your area is not weighted as much in rates policies and is among the 13 states that have a pure relative mistake policy - cheaper.

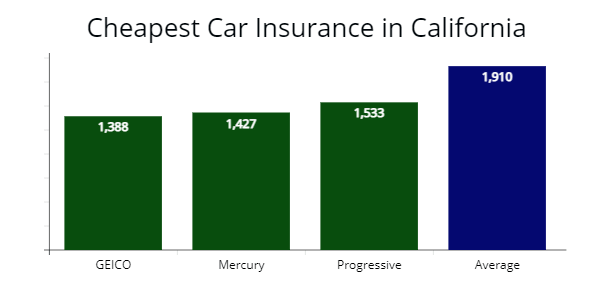

Geico is the most inexpensive for elderly chauffeurs with a typical expense of $1200 a year in California. Some chauffeurs are eager to pay a bit extra for outstanding customer care, some want the most affordable rates, while others like carriers that can deal with claims and also repayments via mobile applications, some like agents. Identifying ideal cars and truck insurance coverage in California, To recognize the, we examined leading carriers in the state as well as ranked them on claims, client fulfillment, economic toughness, online purchasing and also cost.Car, Insurance coverage. Car Insurance Policy Study, Wawanesa received leading positions as the finest auto insurance policy in California for consumer satisfaction. Geico had the lowest rates amongst the best insurance policy companies in The golden state checked Discover more here for car insurance costs, it had the greatestcomplaint ratio. State Farm was the most pricey, yet had the most affordable issue ratio and mastered claims handling and also on the internet buying experience. Power, as well as made a 4 for cases taking care of. Geico Deal seekers, as it has the most inexpensive rates overall for chauffeurs in The golden state, and also is additionally cheapest for vehicle drivers with tickets as well as accidents in addition to elderly drivers. Though it obtained a 4 rating from Auto, Insurance. com for claims as well as put fourth in J.D. Power's rankings however made high marks (4 out of 4) for insurance claims managing from Vehicle, Insurance policy. com. State Farm Youthful vehicle drivers, teen vehicle drivers and also trainee drivers as well as those searching for unique insurance coverages and also an excellent on-line buying experience. State Ranch had the least expensive whine proportion on the finest list, the highest possible score for insurance claims as well as likewise placed well for online buying and customer complete satisfaction. com considers it amongst the carriers in the Golden State, along with the nation. USAA had the greatest J.D. Power client contentment rating in the nation(880 )and additionally covered the listing of best insurers in Cars and truck, Insurance policy. car. com's rankings. Military participants can capitalize on specialized coverage alternatives around implementation as well as storage, while also getting discounts for low-mileage. Your age, your driving document, the version of vehicle you have, the severity and frequency of insurance claims in your area and various other variables are utilized by companies to identify the cost of your policy. That's why the rate for the exact same protection can differ substantially among insurance provider and also why you ought to compare prices. Maximizing price cuts, for example packing your residence and vehicle with the same company can conserve as much as 12% on your auto costs. Dropping detailed and crash for autos that are worth less than$3,000 Treking your deductible quantity, for example, from$500 to$ 1,000 postal code, Standard individual details name, age, birthday, Driving background, Existing insurance provider, Information on various other motorists in your household, Lorry makeas well as design, Desired insurance coverage types, limits, and deductibles, All automobiles VIN (vehicle identification number)If you own, lease or finance your vehicle, Yearly gas mileage, All family vehicle driver's license numbers, Quantity of time you've been guaranteed, Once you supply the details, you will commonly obtain a quote that is in numerous instances a quote of what you will pay. To drive legally, you have to purchase the very least the minimal coverage needed by state laws, which indicates just responsibility insurance that pays for others'injuries as well as damages you create. If you didn't obtain money from a lender to purchase your car as well as you do not have a lot of cash or assets to shield, that could be a sensible choice. In addition, if you have a house and also cost savings to secure, it's smart to purchase even more protection. Liability Coverage, The more cash as well as assets you have, the a lot more likely it is that you may be sued adhering to an auto accident. Unless you are identified to pay the most affordable car insurance coverage rate feasible, we recommend you buy higher than minimal responsibility protection. Space insurance policy, If you obtained a finance to pay for your cars and truck and have an accident, void insurance coverage pays the difference in between the money worth of your cars and truck as well as the existing outstanding equilibrium on your finance or lease. your car is much less than one year old as well as you have actually placed much less than 20 percent down on it, you need to purchase gap insurance coverage. com has the devices to assist you do that. You can get typical rates by ZIP code, as well as below you can see just how much it costs , on average, to guarantee a specific make and also model car in California. Enter the year, make and version and also state and see just how much you must allocate insurance coverage. 3 ways to minimize auto insurance coverage in California, Here are key ways California chauffeurs can conserve cash and also get low-cost car insurance coverage costs. Contrast quotes, A minimum of annually upon renewal, contrast quotes for the similar insurance coverage from at the very least 3 automobile insurer. Need assistance remembering? Download our mobile insurance reminder application. Your driving document and years licensed, amongst other variables, are also thought about when service providers establish your rates, yet in California your credit reportis not. Pay-per-mile plans, such as City, Mile, are one choice the less you drive, the much less you pay. Usage-based plans, such as Progressive's Photo or State Ranch's Drive Safe & Save can gain you a discount if your driving habits prove to be safe. Safe vehicle driver discount rate, State legislation mandates that you get a 20 %price cut if you have a clean driving document and have actually been certifiedfor 3 years. Fully grown driver price cut, If you are age 55 or older and also effectively finish an approved defensive vehicle driver program, your insurer must provide you a price cut, generally 5%to 15%, for three years. com Senior Consumer Expert Penny Gusner. Insurance providers have up until July to submit gender-neutral vehicle score plans to the state's Insurance Department for evaluation. Utilizing gender is rather debatable as insurance coverage business maintain it's an equality based on their actuarial research study, while customer advocates suggest it is prejudiced." The The golden state ban begins the heels of another legislation that went into result there this year, which permits residents to select 'nonbinary 'instead of'male'or 'female'on vehicle driver licenses. Newbie female chauffeurs will usually be impacted the most, by paying extra, if gender is taken out of the price computation. Female vehicle drivers from age 16 to 24 pay, generally, around$500 much less( 15 percent )a year for auto insurance compared to their male equivalents, according to Auto, Insurance policy. Our rate information reveal from age 25 to 65 rates for males and also females are within 5 percent of each various other, with prices for men a tad more affordable from age 45 to 75. After age 75, women begin once again to pay less, yet just around 7 percent, or$100, annually. One more example: there are three states( California, Hawaii and Massachusetts )that protect against credit rating from being utilized to set automobile insurance costs. There are additionally varying regulations and also guidelines on how rates, as well as rate walks, are regulated. Various other states that ban usage of sex in establishing vehicle insurance costs: Hawaii, Massachusetts, Montana, North Carolina and Pennsylvania. The strategy functions by taking your application as well as assigning it to an insurance provider - cheap insurance. All insurance provider accredited in the state has to approve CAARP applicants. The variety of CAARP jobs is based on insurer market share. The more policies an insurance provider issues, the bigger the section of CAARP tasks it is required to take. The plan also uses installation alternatives. After three years with a clean driving record, you can leave the CAARP program and buy a conventional plan. To acquire a CAARP policy, you need to collaborate with an agent that is accredited by the state to assist in getting vehicle drivers these special policies. 003 individuals-$50,400 - car insurance. 004 individuals-$60,750. 005 people-$ 71,100. 00Pure comparative neglect, California is among the 13 states that have a pure relative fault regulation. States with pure comparative carelessness laws let all chauffeurs recover some settlement for their damages, also if they are mainly to condemn. Claims, You ought to submit an insurance claim without delay after an accident. Your policy should specify what is called for of you, which might state a reasonable amount of time or provide a certain time-frame in which to make the insurance claim. For instance, you generally need to submit a swiped automobile claim within 1 month of the burglary. Under California legislation, insurer are called for to approve or reject the insurance claim within 40 days after getting proof of the case. If the case is accepted, repayment has to be made within 1 month from the date negotiation was gotten to. You have up to three years to submit a building damages suit. You have up to 2 years after the incident to submit an accident suit. What is the new auto insurance coverage elegance duration in The golden state? You shouldn't presume there's a poise period, and also rather plan to have insurance policy in place. If you're buying a new car, and also do not currently have insurance, you need to have insurance coverage before you drive the car off the great deal. It can be called for whether you have a cars and truck or not. If you do not possess a vehicle, and need an SR-22, it's most likely that a state regulatory entity is needing you to have an insurance provider license that you have the capacity to pay future car accident cases(up to the certain mandated restrictions). You'll likely require to acquire a policy before your driving opportunities are reinstated if you're not currently insured. You'll need to call your insurer as soon asa court or state entity allows you understand that you require an SR-22. Not all insurance provider file SR-22 types, so you'll have to inspect to verify yours does. States can mandate particular non-car owners to get automobile insurance and also lug an SR-22 to confirm financial duty since state firms know that it's possible for these people to be negligent and damage various other individuals as well as their building while driving, also if the automobile they're running isn't possessed by them.