: If you have actually financed your lorry, your lending institution might need particular kinds of protection as well as restrictions on insurance deductible quantities. vans. While you may be able to afford a higher deductible, your lender might not enable it.: If you have actually obtained in numerous crashes in the recent past, you could be at a higher danger of getting in an additional one, and a lower deductible might be a better alternative.

There's no one-size-fits-all solution for everybody, so it's crucial to think about these aspects and various other aspects of your scenario to choose the appropriate deductible for you. Various Other Ways to Reduce Car Insurance Coverage, Choosing the right insurance deductible can give you a good equilibrium between saving on your month-to-month rate and the amount you owe when you sue - car insurance.

Other methods to save money on car insurance consist of: Shopping around and contrasting quotes from numerous insurance companies, Applying price cuts that you get approved for, Making changes to coverage amounts, Improving your credit report, Insurance firms in a lot of states utilize your debt record to develop what's called a credit-based insurance policy score - cheapest car. They after that utilize this score to help establish your rate.

When it involves automobile insurance policy, an insurance deductible is the quantity you 'd have to pay of pocket after a protected loss prior to your insurance policy coverage starts. Cars and truck insurance deductibles function differently than medical insurance deductibles with vehicle insurance coverage, not all sorts of protection need an insurance deductible. Obligation insurance doesn't require an insurance deductible, but extensive and also accident insurance coverage typically do.

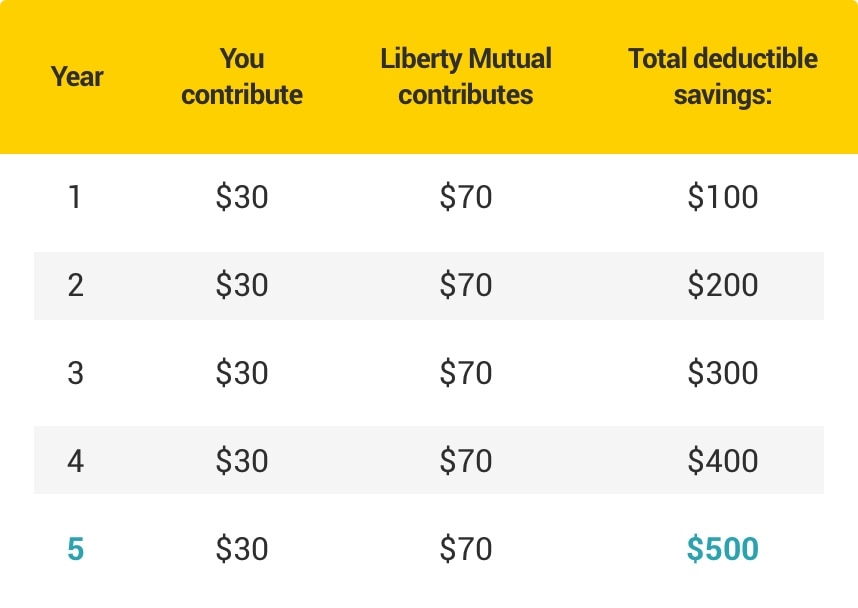

When you're adding that insurance coverage to your cars and truck insurance plan, you'll typically have the opportunity to determine where you wish to set the deductible. Generally, the greater you establish your insurance deductible, the reduced your regular monthly insurance policy premiums will be yet you do not wish to establish it so high that you wouldn't have the ability to in fact pay that quantity if needed. auto.

Some Ideas on How To Choose Your Car Insurance Deductible - The Balance You Should Know

What does a car insurance policy deductible mean? A insurance deductible is the quantity of cash you need to pay of pocket prior to your vehicle insurance will certainly cover the remainder - cheapest car insurance. As an example, if you backed your auto right into a telephone post, your collision insurance policy would pay for the cost of the damages.

If the complete price of repair work concerns $1800, your insurance coverage will only pay for $1300. You can locate your insurance deductible amounts is provided on your affirmations web page. Having to pay an insurance deductible means you can do a type of cost-benefit analysis prior to you make an insurance claim with your insurer.

What kind of protection calls for an insurance deductible?, which covers the expenses if you harm a person's building or injure somebody with your car, never ever needs a deductible., and where you establish your insurance deductible will certainly have an affect on your regular monthly insurance policy premium.

The reverse is additionally true, choosing a reduced insurance deductible means you'll have to pay a higher costs - cheaper cars., however remember, there's a really real opportunity you'll have to pay that deductible sooner or later.

The Best Guide To What's A Deductible In Car Insurance?

The auto insurance deductible is the amount of money you will first be accountable for before the insurance coverage firm begins to cover prices - vehicle insurance. Unlike wellness insurance policy, auto insurance coverage deductibles are typically on a per insurance claim basis significance you would certainly have to cover these expenses every time you sue.

Just how does the insurance deductible job? Your insurance deductible, usually around $750 will be very first applied to any type of damages.

The remaining $2,750 would certainly after that be covered through the accident coverage by your insurance firm. In many cases where an additional chauffeur is at mistake for the crash you might desire to submit a third-party claim against their Under these conditions your insurance company might seek a process called subrogation to recover the quantities they have actually already paid (insure).

It is also vital to keep in mind that since vehicle insurance deductibles are on a per-claim basis so the regularity of your cases will certainly be just one of the most vital aspects (car). If your plan has a $500 deductible and also you were associated with 4 different claims of much less than $500, after that you would certainly be accountable for 100% of all the payments as well as your insurance policy would have provided no insurance coverage.

One technique you can take is to look at your driving and also automobile background. If your background shows that you might need to make more constant claims, you may want to take into consideration choosing a plan with reduced expense costs. On the other hand, if you have not had a background of mishaps you may not require a reduced insurance deductible plan.

Little Known Questions About How To Choose The Right Car Insurance Deductible - Metromile.

Whether you're a brand-new chauffeur or have actually lagged the wheel for several years, it can be discouraging to learn insurance terms like "deductible." Your automobile insurance coverage deductible influences the price of your insurance, so it's vital that you pick one thoroughly. The insurance deductible that's right for you relies on your specific conditions.

Just how does a deductible job? An insurance deductible is the amount of money you pay out of pocket before your insurance coverage kicks in as well as starts paying for the expenses of your loss.

Not all insurance coverages need an insurance deductible, however if your own does, you'll pick the quantity. Your deductible will certainly impact your month-to-month insurance repayment the reduced your insurance deductible, the higher your cars and truck insurance policy premium.

Automobile insurance coverage plans can include various kinds of coverage that offer differing purposes, and also you can choose to be covered by some or all of them. Some of these coverage alternatives call for deductibles and some don't, so it's worth noting what deductibles you'll be called for to pay. State regulation usually figures out whether or not a deductible is required. cheaper.

This covers you if your vehicle clashes with one more car or item and also you require to pay for fixings. Accident deductibles are common however vary by insurance firm. If your lorry is harmed by an occasion such as fire, a falling things hitting your windscreen or criminal damage, you'll submit an extensive coverage insurance claim (perks).

How Ma Auto Insurance Deductibles Work - The Facts

Deductibles are in some cases required for this insurance coverage, yet not constantly, and needs differ by state. While your automobile insurance policy deductible can differ considerably depending on many elements, including just how much you desire to pay, cars and truck insurance policy deductibles commonly vary from $100 to $2,500 (liability).

When choosing a deductible, you'll require to think about multiple aspects, including your budget plan. Invest some time computing just how much you can afford to pay for a deductible as well as just how much you'll save money on your month-to-month premiums by choosing a higher one - credit score. Ask yourself these concerns when choosing an insurance deductible amount.

If you obtain in a mishap, can you afford the insurance deductible or would you have a hard time to pay it? Taking on a high insurance deductible might not make much feeling if it represents a big section of the auto's worth.

Insurance policy providers use deductibles to help reduce their threat including you, the insured party. What Is an Automobile Insurance Coverage Deductible? When you require your insurer to spend for repair services to your car, they will certainly require you to pay your deductible (liability). The insurance deductible is the quantity of cash you consented to compensate front for fixings prior to the insurer kicks in to pay for the remainder.

Not all car insurance policy protection needs a deductible, but you will generally find a deductible is called for for the list below sorts of coverage, according to Progressive: Comprehensive, Collision, Personal injury protection, Uninsured/underinsured motorist, The deductible will certainly work similarly despite the protection kind as well as will be called for at any time you make a claim (cheap car insurance).

Facts About Choosing Your Deductibles To Save Money - National Bank ... Uncovered

You could likewise have to pay your insurance deductible if your windshield is damaged, although some insurance firms do supply full glass protection as an option. Are There Times When No Insurance Deductible Is Called for?

So although you caused the accident, you do not have to pay anything out of pocket when someone makes a case against your liability insurance for problems you cause to their home or for injuries. Various other scenarios where you won't be called for to pay an insurance deductible include: An insured chauffeur hits you.

You go with totally free repairs on your glass. Being associated with a mishap with one more guaranteed motorist, where the mishap is regarded their fault, indicates you will not have to pay an insurance deductible because you'll be making an insurance claim via their responsibility insurance coverage. Nonetheless, you do Helpful resources have the choice to make a case via your own crash protection, if you have it.

When speaking with Allstate, we figured out that, depending upon the state you reside in and the insurance policy carrier you make use of, there is a zero-deductible alternative available. Obviously, picking a zero-deductible option on your insurance plan will likely lead to a higher monthly costs. This is because all the threat is now thought by the insurance business.

The best amount for you will certainly depend on your financial scenario due to the fact that your insurance deductible impacts your month-to-month premium price. Progressive suggests that you maintain this in mind when deciding what total up to establish for your insurance deductible: A greater deductible means a reduced month-to-month premium, yet a higher out-of-pocket price when making an insurance claim.

The smart Trick of Car Insurance Deductibles: How Do They Work? - The Motley ... That Nobody is Talking About

Knowing what your vehicle insurance policy deductible is and when you have to pay it is an important aspect of determining what kind of insurance policy coverage you desire. Ensure you'll have the ability to cover the insurance deductible quantity when you make a claim to your insurance business to prevent any kind of issues with getting repairs cared for in a timely way (vehicle insurance).

For any type of feedback or improvement requests please contact us at. Sources: This content is developed as well as kept by a 3rd event, as well as imported onto this web page to aid customers supply their e-mail addresses. You might have the ability to locate even more details concerning this and also similar web content at (car insurance).