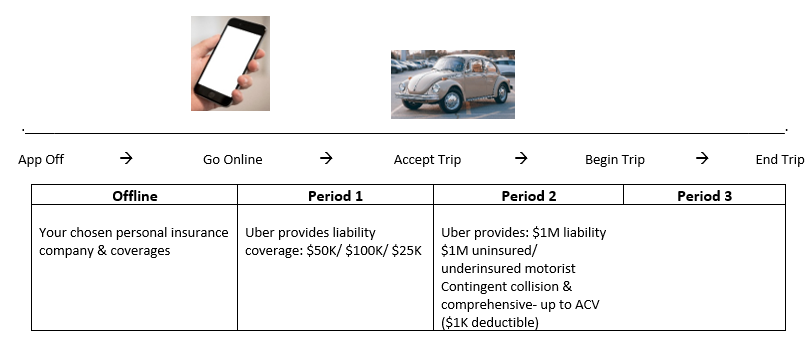

What Is Rideshare Insurance policy? Rideshare insurance policy supplies protection for rideshare chauffeurs Visit this website in the occasion of a mishap or costs linked with damage or medical care prices. The insurance coverage market divides rideshare insurance protection into 3 durations of time: Period 1 takes place when you have the application transformed on however haven't approved a flight.

cheapest car auto insurance vans cheaper auto insurance

cheapest car auto insurance vans cheaper auto insurance

One instance is if you were driving about, waiting on a trip request on the application, and created a fender bender. In that instance, rideshare business wouldn't cover your costs, and also your very own personal automobile plan may refute your case if they weren't formerly aware that you were driving for pay.

trucks car insured trucks credit

trucks car insured trucks credit

Still, you'll desire to do your research - cheaper auto insurance. Pro Tip, Talk to your insurance provider and also ask to talk to someone acquainted with rideshare insurance coverage who can inform you exactly what your rideshare add-on will cover this will assist you accurately compare protections and also premium expenses - cheapest auto insurance.

low cost auto vans vehicle insurance vehicle insurance

low cost auto vans vehicle insurance vehicle insurance

If you are fretted that the premium you're priced quote is too high, seek out at the very least 2 other quotes - cheapest auto insurance. You can additionally think about reduced coverage limits that are still within what you wish to acquire, which can conserve you cash - low cost. There can additionally be added costs when purchasing rideshare insurance policy.

car insurance affordable insurers cars

car insurance affordable insurers cars

The deductible is typically $2,500 for the detailed as well as crash protection - credit. Uber chauffeurs will certainly require to divulge that they are driving for a rideshare firm and also get rideshare insurance on their individual auto insurance coverage to cover any accidents they cause during Duration 1 (insurance affordable). Vehicle drivers may additionally wish to obtain added insurance coverage throughout Durations 2 and 3, if the $2,500 deductible is too high.

How Rideshare Insurance: What's It Cover? (2022 Cost, Companies) can Save You Time, Stress, and Money.

If you are a rideshare vehicle driver, it is very important to make certain that you aren't leaving on your own in jeopardy by merely driving with a basic individual automobile plan - insured car. Make certain to call your insurance provider as well as inquire about your alternatives as well as the insurance costs connected with rideshare driving before you activate that application - insurers.

If you rely on your individual policy, it will not cover you as well as your travelers during particular parts of the journey. It doesn't matter what sort of insurance coverage you have, how high your insurance coverage limits are, or how commonly you drive for a rideshare solution - car insurance. However, it's possible that the rideshare firm you drive for offers some coverage during the journey.

Before you choose to forgo rideshare insurance, check to see what sort of coverage you have through the rideshare company, if any type of. Contrasting Rideshare Insurance Companies It is very important to contrast rideshare insurance policy companies before you choose one. Below are a few of the factors you should consider before purchasing a plan: Not all rideshare insurer offer coverage in all 50 states.

What Insurance Coverage Does Rideshare Insurance Policy Supply? Rideshare insurance policy intends to fill up the space between a driver's very own personal vehicle insurance and also the protection offered by the rideshare company. Rideshare firms as well as insurance coverage carriers have actually concurred on a basic guideline for rideshare protection. These durations of work, commonly referred to as phases, are: The rideshare application is off (auto).

Do You Need Rideshare Insurance Coverage? While some rideshare business do not need drivers to have rideshare insurance policy, Uber and Lyft do call for all of their chauffeurs to be independently insured.

What Does Best Rideshare Insurance Companies 2021 - Money Under 30 Mean?

See Currently: When you're a rideshare motorist, insurance coverage depends on when the accident takes place: Duration 0 App is off, and you're not ridesharing. Your individual insurance coverage policy may cover you if a crash occurs.

Period 2 You have actually been matched with a rider, and you're on your way. Your rideshare company provides key coverage during this time around. cheapest auto insurance. Period 3 Your bikers are aboard. Your rideshare company's policy covers any kind of crashes while your passengers are in the automobile. If you end up being a rideshare chauffeur, make sure to tell your insurance firm (prices).

Talk with a representative to more regarding rideshare coverage from AAA Insurance. The accessibility, credentials, and amounts of insurance coverages, costs as well as price cuts may differ from one state to another as well as there might be coverages and price cuts not detailed right here (insure). On top of that, various other terms, conditions, as well as exemptions not explained above might apply, and total cost savings might differ depending upon the insurance coverages purchased (credit score).

trucks prices car cheap car

trucks prices car cheap car

Your protection from Uber, Lyft or any various other rideshare provider that offers the protection is in complete impact. Does rideshare insurance coverage cost more?

Since of that, it's significantly less costly than business insurance coverage. Get in touch with your insurance coverage representative to discuss your insurance protection, whether they use it and also to obtain an insurance quote.