insurance risks insurance company credit score

insurance risks insurance company credit score

What is a detailed insurance deductible? A detailed insurance deductible is the amount of cash that you are responsible for paying toward an insured loss - cheap auto insurance. The quantity of the insurance deductible is deducted from your claim repayment in case of a vans protected accident. Generally, extensive deductibles range from, as automobile insurance policy deductible selections differ depending upon your state laws and also insurer standards.

Why you may not want a high comprehensive insurance deductible? A high insurance deductible can indicate that you have to pay even more out of pocket in case of a mishap or various other covered loss - auto insurance. This can be particularly troublesome if you do not have a lot of cost savings or reserve to cover these costs. cheap insurance.

As an outcome, you might not be able to get the complete quantity of insurance coverage you need if you have a high deductible. Having a greater deductible makes it harder to get approved for specific discounts. Numerous insurance policy business use price cuts for low-mileage vehicle drivers. Nevertheless, if you have a high insurance deductible, you may not have the ability to get these discount rates.

The most your insurance will certainly payout is the vehicle's actual cash money worth what the auto deserved on the marketplace before the damage took place minus your picked deductible amount. You can discuss the real cash value of your vehicle in the occasion of an overall loss by supplying different examples of similar vehicles.

Extensive insurance claims and your prices, Many states' insurance policy laws require that comprehensive insurance claims be covered by the policy. The rate boost is generally modest since extensive cases are not linked to the insurance policy holder's driving. Unlike obligation or accident claims for accidents, extensive claims normally won't raise your rates. The exemption may be if you submit several cases in a very brief duration of time.

The Definitive Guide for Car Insurance Deductibles & How They Work

What is a deductible? An insurance deductible is the quantity you pay of pocket toward repair services for your automobile because of a protected loss. If you have a $500 insurance deductible and you're in a mishap that results in $3,000 of fixings to your auto, you pay only $500 toward fixings (low cost auto).

low cost affordable car insurance cheap auto insurance laws

low cost affordable car insurance cheap auto insurance laws

In the majority of markets, when you're not responsible for an accident, we can waive the deductible if we can determine the other celebration, that they're at fault, and also their insurance service provider verifies they have valid responsibility protection for the crash. This investigation can take some time, so the insurance deductible might apply at the beginning of the claim and be reimbursed later on - auto insurance.

Your deductible just applies when your insurance business pays for your vehicle repairs. There is no deductible if the other celebration's insurance is dealing with the repair work.

automobile cars credit score cheap insurance

automobile cars credit score cheap insurance

Whether you're a new motorist or have been behind the wheel for years, it can be daunting to learn insurance coverage terminology like "insurance deductible." Your car insurance coverage deductible influences the cost of your insurance policy, so it's vital that you select one thoroughly (low-cost auto insurance). The insurance deductible that's right for you relies on your specific conditions. auto.

If you require to submit a case with your cars and truck insurance carrier after an accident, or when your auto is or else damaged, there's a great chance you'll need to pay a deductible. auto insurance. Exactly how does an insurance deductible work? An insurance deductible is the quantity of cash you pay of pocket prior to your insurance protection kicks in as well as begins spending for the expenses of your loss.

Controlling The Cost Of Auto Insurance - Nj.gov Can Be Fun For Everyone

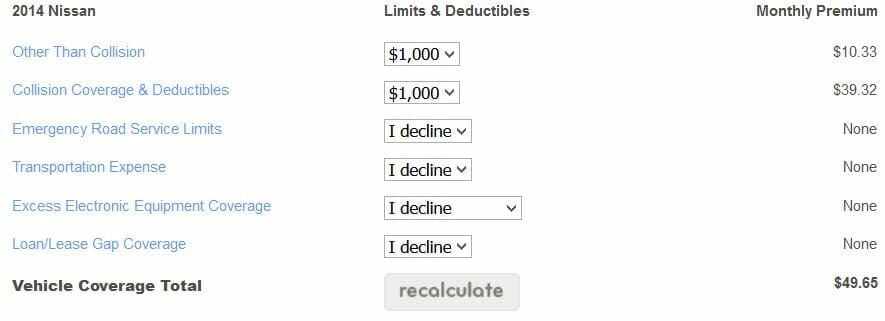

Not all insurance coverage protections require an insurance deductible, yet if your own does, you'll pick the quantity. Your insurance deductible will certainly affect your regular monthly insurance coverage payment the reduced your insurance deductible, the higher your vehicle insurance coverage costs. When buying quotes from auto insurance coverage firms, try out just how various deductibles will certainly impact your monthly settlements.

Auto insurance policy plans can consist of different types of protection that offer differing purposes, and also you can pick to be covered by some or all of them. State legislation normally determines whether or not an insurance deductible is required.

This covers you if your vehicle rams another lorry or object as well as you need to spend for repair work. cheaper auto insurance. Accident deductibles are standard but vary by insurance firm. If your car is damaged by an occasion such as fire, a dropping things hitting your windscreen or criminal damage, you'll file a detailed protection insurance policy case.

cheapest insurers dui trucks

cheapest insurers dui trucks

affordable prices low cost auto accident

affordable prices low cost auto accident

Deductibles are occasionally required for this insurance coverage, but not always, and also requirements differ by state. While your automobile insurance policy deductible can vary greatly depending on many elements, consisting of just how much you want to pay, vehicle insurance policy deductibles usually range from $100 to $2,500.

When picking a deductible, you'll require to think about several variables, including your spending plan (vehicle). Invest some time determining just how much you can manage to pay for an insurance deductible and how much you'll minimize your regular monthly costs by opting for a greater one. Ask on your own these concerns when selecting a deductible amount.

How Understanding Auto Insurance can Save You Time, Stress, and Money.

You require this buffer in situation the most awful happens, yet if you're a secure driver or don't drive usually, utilizing an emergency fund to cover any accidents may be an option. This is an important inquiry when considering what insurance deductible to pick. If you enter a mishap, can you pay for the deductible or would certainly you struggle to pay it? Taking on a high insurance deductible might not make much sense if it stands for a huge portion of the cars and truck's worth.

Anytime you're in a cars and truck accident as well as there are problems to your cars and truck that would certainly be covered under thorough or collision insurance coverages, you'll be responsible for paying the deductible under each of those protections (car insured). If you have numerous autos on your car insurance policy, you can likewise choose various deductibles for each car - insurance companies.

You can choose various protection restrictions for all of them, as well as set deductibles, depending on which protection it is. Why can't you always choose your insurance deductible?

Due to the fact that they aren't responsible for as much cash, they have less danger. So they bill a lower vehicle insurance policy premium. Simply put, a higher deductible equates to lower insurance costs. A reduced insurance deductible equates to greater insurance policy costs. An instance would be an insurance policy with a $500 collision insurance deductible.

When choosing car insurance policy protection, you selected the low deductible of $500. car insurance. The insurance provider would certainly currently have to pay out $9,500. What if you chose a high deductible of $2,500?